90% of Your Clients Never Log Into Your Portal

12 min Read

Why 90% of Your Clients Never Log Into Your Portal (And What Actually Works)

Here’s an uncomfortable question: If you have a client portal and clients don’t use it, do you actually have a client experience?

I’ve had this conversation with hundreds of advisors over the past fifteen years. It usually starts the same way. An advisor proudly tells me about their firm’s client portal: all the features it has, all the reports clients can access, all the account information available at their fingertips. Then I ask a simple question: “How many of your clients actually log in?”

The room gets quiet.

Most advisors know the answer, even if they don’t want to admit it. 10% of clients use the portal regularly, 15% if they’re lucky. The rest? Radio silence.

And that’s not just anecdotal. When we do primary research with advisory firms, the numbers are consistent across the board. Traditional client portals average around 10% engagement. Let that sink in for a moment. You’ve invested in technology, your team has learned how to use it, you’ve onboarded clients, and 90% of them never come back.

The Most Common Client Experience Is Silence

Let’s do some math together. If you’re operating on a traditional advisory model, you meet with clients two to four times per year. You send out quarterly performance reports. If you’re ahead of the curve, you might have a monthly newsletter. Add it all up, and you’re looking at 20 to 25 touchpoints per year.

Sounds reasonable, right? Here’s what it actually means: For 340 days a year, your clients hear nothing from you.

Think about that from your client’s perspective. They’ve entrusted you with their life savings, their retirement dreams, and their children’s education fund. And for 340 days out of the year, you are completely silent. You’re simply not relevant in their lives.

During that silence, what do they hear instead? CNBC. Bloomberg. Their friend at the country club, who just made a killing on Bitcoin. Reddit. TikTok. Every financial influencer with a smartphone and an opinion.

According to research I’ve seen, the average person encounters five or six different messages daily about how they should handle their money. That’s over 1,800 messages per year competing for your client’s attention. And how many times are you part of that conversation? Twenty? Twenty-five?

You’re being out-communicated 75 to 1. We wonder why clients call in a panic during market volatility or show up at meetings with “great ideas” they heard about on social media.

Why Traditional Portals Fail

Most client portals in our industry were designed with a fundamental flaw: They’re passive. They sit there, waiting for clients to remember to log in, waiting for clients to seek out information, waiting for clients to take action.

But that’s not how people interact with digital services anymore.

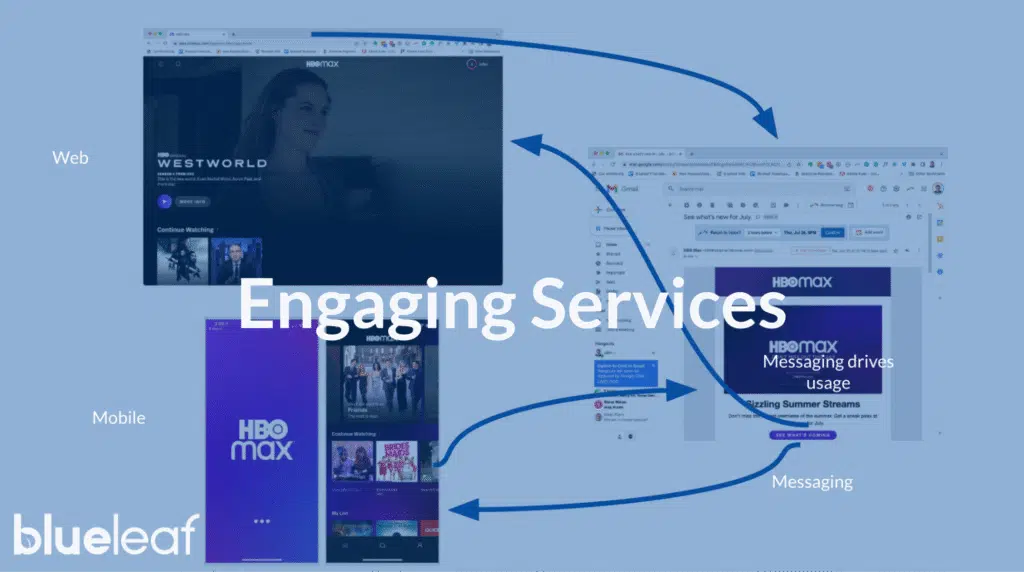

Think about Netflix for a minute. Does Netflix wait for you to remember to log in and see what’s new? No. Netflix sends you an email: “Based on what you’ve been watching, here are three shows you might like.” Netflix sends you a notification: “Season 3 of your favorite show just dropped.” Netflix makes sure you remember they exist, that they have value for you, that there’s a reason to come back.

The same goes for Amazon, Facebook, your banking app, and your healthcare provider. Every successful digital service understands a simple truth: People don’t log into passive systems. They engage with active ones.

Your client portal may be beautifully designed. It might have impressive functionality. If it’s just sitting there passively, waiting to be used, it doesn’t matter how great it seems. It’s a tree falling in a forest with nobody around to hear it.

The Behavioral Psychology of Engagement

Here’s something most advisors don’t think about: Client portal usage is not about the quality of the information you provide. It’s about human behavior and habits.

People form digital habits around two things: consistent value and low friction. If something consistently delivers value with minimal effort, people will use it. If it requires them to remember, to seek out, or to navigate complexity, they won’t.

I learned this lesson early at Blueleaf. We used to think the problem was features. If we just added more charts, more data, and more functionality, clients would log in more often. Wrong. Dead wrong.

What we discovered through years of testing and research is that engagement is about making it obvious, easy, and frequent. Clients need to see value without having to work for it. They need to be reminded that you exist. They need small, snackable pieces of information that fit into their daily digital habits.

Think about how many times you’ve opened your email today. How many times have you checked your phone? Now think about how often your clients think about logging into their financial portal. That gap? That’s the engagement problem.

What Clients Actually Want

During the pandemic, something interesting happened. Clients who had never had a virtual meeting suddenly embraced them. Clients who had never used online banking became regular users. Why? Because they had to, yes, but also because the experience was better than they expected. And they haven’t gone back.

The data is clear: According to a recent Fiserve article on expectations and experiences, clients over 70 now use online banking an average of seven times per month. That’s up 100% from just a few years ago. Grandma isn’t just on Facebook anymore. She’s managing her finances digitally, attending virtual doctor’s appointments, and yes, expecting her financial advisor to meet her in the digital space she now inhabits.

Here’s the critical distinction: Those successful digital services didn’t just give clients a login and hope for the best. They actively engaged clients. They sent notifications. They delivered value proactively. They met clients where they were, on their terms, in their preferred channels.

Your clients don’t want another checklist item to remember. They want information that comes to them. They want updates that fit into their existing digital habits. They want to feel like you’re thinking about them, even when they’re not actively thinking about you.

The Hidden Costs of Low Engagement

Let’s talk about what low portal engagement is actually costing you.

First, most of you are getting a portal with other technologies, like your reporting system (Blueleaf includes Engage too) or your financial planning system, so it seems “free”. But “free” can cost a lot. Low engagement means:

More panicked calls during market volatility. When clients aren’t hearing from you regularly, they’re much more susceptible to market panic. During the 2020 COVID crash, advisors with high client engagement had dramatically fewer panicked calls. Why? Because their clients were already hearing from them regularly, already understood their strategy, and already trusted the process.

Reduced share of wallet. Engaged clients are far more likely to consolidate assets with you. When they inherit money or change jobs or sell a business, they think of you first, but only if you’ve been present in their lives. If you’re one of those silent 340-day-a-year advisors, why would they automatically think of you?

Fewer referrals. This is the big one. Referrals come from clients who are thinking about you, talking about you, and excited about the value you deliver. If clients rarely interact with your services, they’re simply not thinking about you enough to refer you.

Lower client satisfaction. Clients who aren’t engaged with your services are less satisfied. They don’t see the ongoing value you deliver. They question what they’re paying for. When it comes time for your quarterly or annual meeting, they’re looking at that fee on the statement and wondering what you actually did to earn it.

What Actually Works

So if traditional portals don’t drive engagement, what does?

The answer is proactive, multi-channel engagement. Instead of waiting for clients to come to you, you go to them. Instead of putting all your eggs in one basket (the portal), you meet clients across multiple channels. Instead of quarterly touchpoints, you create 100+ meaningful interactions per year.

I know what you’re thinking: “John, that sounds exhausting. I don’t have time to reach out to every client 100 times a year personally. And they’ll think I’m bothering them.”

First, no one is bothered by things they find useful or valuable. So it’s a question of value and relevance, not frequency. We have seen time and again advisors on our platform get incredible client reviews because of the value they deliver.

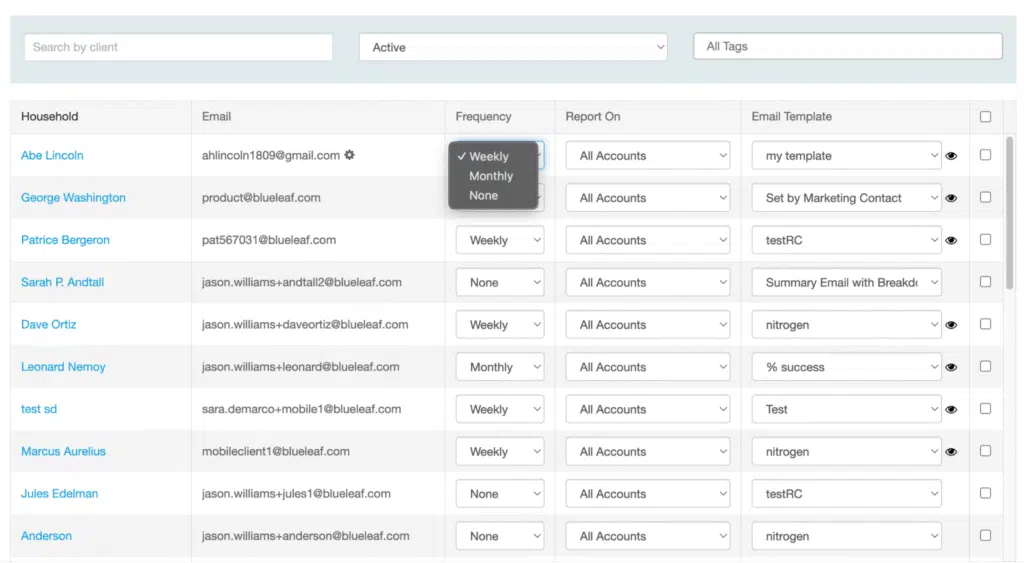

Second, you’re right. You don’t have enough time to do this manually.. That’s why automation is essential. But here’s the key: Automation doesn’t mean generic mass emails. It means personalized, value-driven communications that are automatically delivered to each client based on what matters to them.

The most successful advisory practices I work with create engagement through a mix of:

Automated financial updates. Short, personalized reports on what’s happening with their money. Not performance reports—those go out quarterly. Just simple updates: “Your portfolio balance changed by this much this week. Everything looks good. We’re keeping an eye on things for you.”

Problem-solution content. Usually, this is repurposed marketing content that addresses current financial challenges. “We just helped a client navigate this tax situation. If you have a similar issue, let’s talk.” This isn’t marketing fluff. It’s genuine value that also reminds clients of all the things you do beyond portfolio management.

Service updates. Little videos or messages letting clients know about work you did in the background. “Hey Susan, we just reviewed your asset allocation. Everything looks great. No changes needed. Just wanted you to know we’re on it.”

Traditional outreach. There is still an important place for your typical 20-25 touchpoints with your regular reporting and newsletter, etc. It remains the foundation you build on.

Multiple channels. Email, mobile, web—whatever works for each client. The key is not forcing them to go somewhere new, but meeting them where they already are.

Add it all up, and you can hit 150+ touchpoints per year without overwhelming your team or your clients. And here’s what happens: Clients actually engage. They read your emails. They get answers when they need them. They remember you exist. They understand the value you deliver.

The advisors I know who’ve embraced this approach report engagement rates of over 90% in some cases. Not 10%. Not 15%. Up to ninety percent of their clients are actively engaging with their communications every single month.

The Engagement Economy

We’re living in what we call the engagement economy. Economic value, client satisfaction, and company growth are all tied to engagement. This isn’t just true in wealth management; it’s true everywhere. The companies winning in every sector are the ones that engage their customers most effectively.

During the pandemic, this shift accelerated dramatically. Clients who had been hesitant about digital services suddenly expected them. The bar for digital experiences has been raised across every industry. Healthcare went virtual. Shopping went online. Even grandma got comfortable with video calls.

Your clients now compare your digital experience not just to other advisors, but to Amazon, to Netflix, to their banking app. Those comparisons aren’t fair, I know. Those companies have billion-dollar technology budgets. But fair or not, that’s the reality. Client expectations follow an upward trajectory, and there’s no going back.

Getting Started

If you’re reading this and feeling overwhelmed, I get it. The gap between where you are and where you need to be might seem insurmountable. But here’s my advice: Start simple.

You don’t need to go from 20 touchpoints to 150 overnight. Pick one thing and do it well. Maybe that’s a weekly automated email. Maybe it’s a bi-weekly problem-solution update. Maybe it’s just starting to track your engagement metrics so you know where you actually stand.

The key is to stop thinking about your portal as a destination and start thinking about client engagement as a system. You need multiple touchpoints, multiple channels, and consistent value delivery.

And here’s the thing: Once you start measuring engagement, once you start tracking who’s actually reading your communications and responding to them, you can optimize. You can test. You can learn what works for your specific clients. But you can’t optimize what you’re not measuring.

The Bottom Line

If 90% of your clients never log into your portal, you don’t have a client portal problem. You have a client experience problem. And that problem is costing you money, costing you growth, and putting your client relationships at risk.

The solution isn’t a better portal. It’s a better engagement strategy. It’s moving from passive to proactive. It’s moving from hoping clients will remember you to making sure they can’t forget you.

At the end of the day, your clients want to know you’re thinking about them. They want to understand the value you deliver. They want to feel like you’re on top of their financial lives even when they’re not actively thinking about money.

You can give them that feeling. But not with a passive portal that sits waiting for them to log in. You need something better. You need actual engagement.

The good news? The advisors who figure this out are seeing dramatic results. Higher satisfaction. Better retention. More referrals. Faster growth. And it all starts with asking yourself one honest question: If you have a client portal and clients don’t use it, do you actually have a client experience?

The answer matters more than you think.