Introducing Blueleaf Engage: The Complete Client Experience Platform

10 min Read

For years, we’ve heard the same frustration from advisors: “My clients don’t use our portal.” It’s a problem we know intimately. When we founded Blueleaf over a decade ago, we recognized that most client portals sit passively, waiting for clients to log in. And they seldom do. Industry data shows that traditional portal engagement hovers around 10% monthly. That means 90% of your clients aren’t engaging with your service. And the technology you’ve invested in sits mostly idle.

The problem isn’t that clients don’t want to engage. The problem is that we’ve been asking them to do all the work. Today, I’m excited to introduce Blueleaf Engage: a complete reimagining of how advisors connect with clients digitally.

The Evolution: From Passive to Proactive

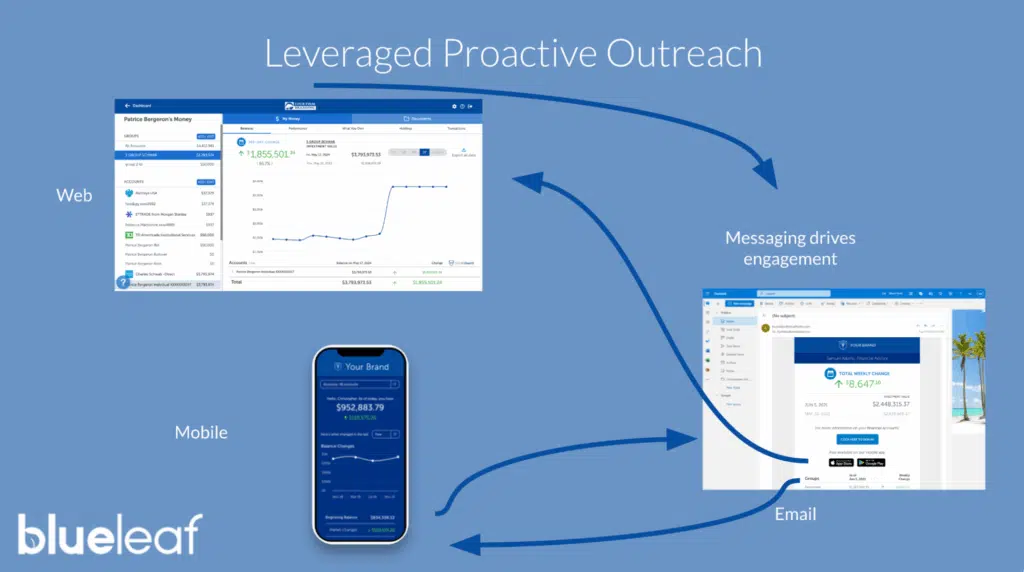

When building Blueleaf in 2010, we had a simple insight: clients engage with services that reach out to them, not services that sit and wait.

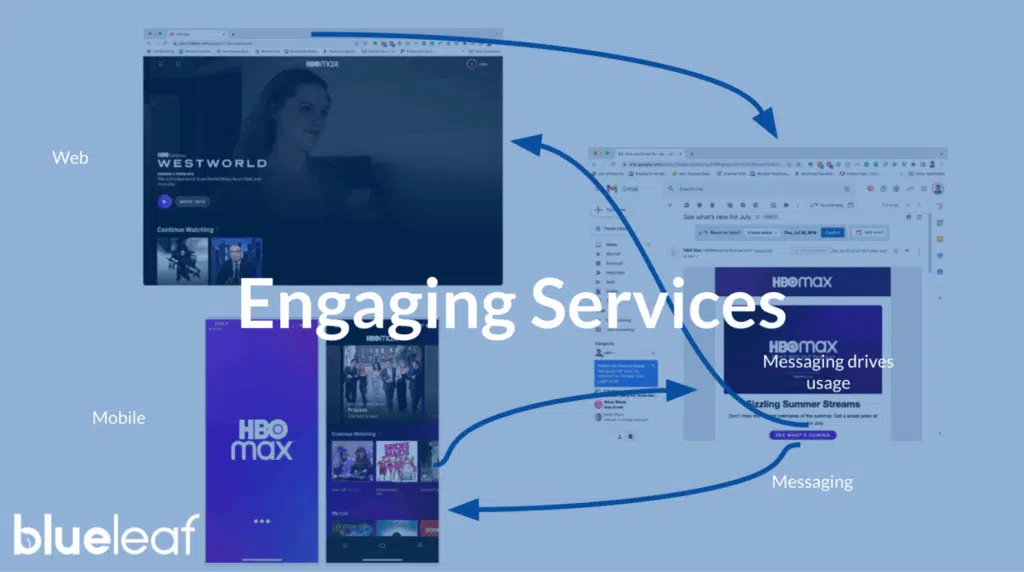

Think about Netflix. You don’t have to remember to check Netflix to see what’s new. They send you emails. They push notifications. They make it easy for you to stay connected to their service. That’s why you use it. The same is true for Facebook and Instagram.

Wealth Management has been doing the opposite. We give clients a portal that sits and waits for them to remember to log in. Then we wonder why they’re not using it.

Over the past few years, the world has changed dramatically. The pandemic accelerated digital adoption across every age group. Even grandparents who claimed they’d never use technology are now video call experts. Clients now expect the convenience and accessibility they get from every other service in their lives. They want their financial advisor to meet them where they are, not the other way around.

Blueleaf Engage is our answer to this new reality.

What Is Blueleaf Engage?

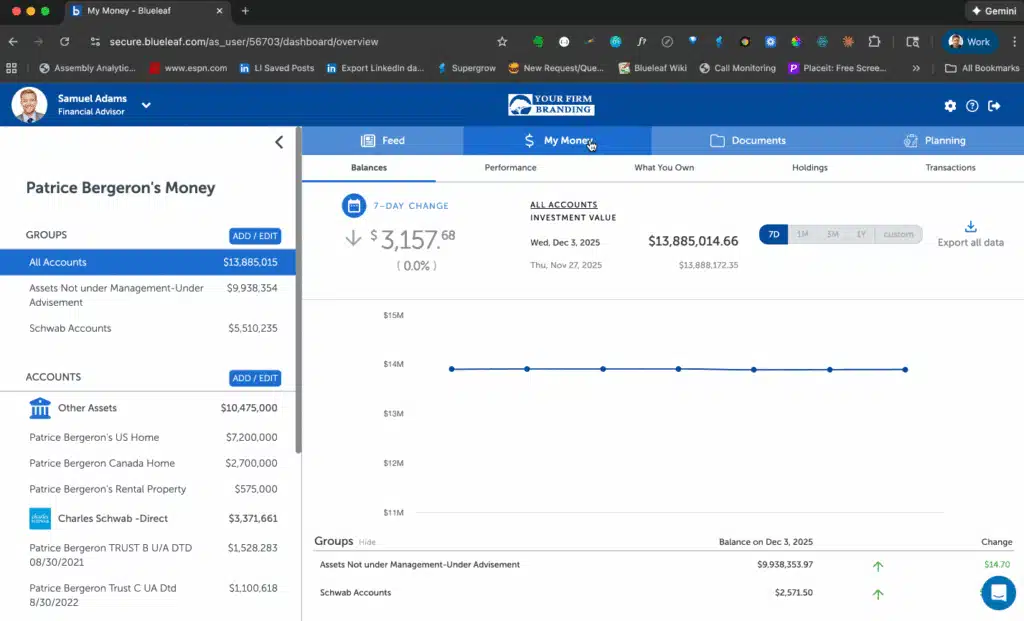

Blueleaf Engage is a comprehensive client experience platform that unifies portfolio reporting, document sharing, and advisor-to-client communications into a single, branded, compliant experience.

Here’s what makes it different: It’s built on a proactive engagement model that looks and feels like the other services they already use.

Instead of waiting for clients to log in, Blueleaf Engage pushes personalized, valuable information to clients across multiple channels: mobile, web, and email. It’s a social media-style communication experience that delivers content clients actually want to consume, in formats they’re already comfortable with.

The result? Our customers see 60-90% monthly client engagement, compared to the industry standard of around 10%.

Let me say that again: 60-90% of clients actively engage every single month.

That’s not a typo. That’s what happens when you stop asking clients to do all the work and start delivering value to them proactively.

The Problem We’re Solving

The most common client experience in wealth management is silence.

If you’re doing quarterly meetings and sending a monthly newsletter, you’re touching clients maybe 20-25 times a year. That means for 340 days a year, you’re not relevant in their lives. They hear nothing from you.

Meanwhile, CNBC is on 24/7. Social media is filled with the latest meme stock or crypto “opportunity.” Your clients are bombarded with financial noise from every direction.

How are you supposed to counteract that narrative with 25 touches a year?

You can’t.

This is why clients call in a panic during market downturns. This is why they come to meetings asking about Bitcoin or whatever TikTok is talking about. They’re hearing everyone else’s narrative about their money except yours.

Blueleaf Engage changes that dynamic by giving you the tools to become consistently present in your clients’ financial lives.

Push Notifications for Multi-Channel Engagement

Here’s the core insight: different clients prefer different communication channels. But that changes even during a single DAY. Think about your own experience. In the first few hours of your day, you probably used a web app, a mobile app, read email, and sent an SMS, depending on what you were doing and where you were. Your clients are the same.

Blueleaf Engage meets clients where they are by delivering the same content across all channels seamlessly:

Social Media-Style Feed: Clients get a LinkedIn-style experience where they can consume your content, market insights, and personalized messages. They can like posts, comment privately, and interact with your content in ways that feel natural to them.

Mobile App & Messaging: Native mobile experience that works seamlessly, with push notifications that keep clients informed without being intrusive.]

Exceptional Web App: For deeper dives, certain content types, or just because a client may be already on their laptop, we deliver a rich web experience that works seamlessly with mobile and messaging.

Email Messaging: Every piece of content is automatically formatted for email. Clients who prefer their inbox get the same information without having to log in anywhere.

In-Platform Messaging: Secure, compliant messaging that keeps conversations in context and creates an audit trail.

Automated Micro-Reports: Regular updates on their portfolio that are snackable and easy to digest. These aren’t 50-page performance reports nobody reads. They’re brief, branded updates that answer the question: “What’s happening with my money?”

The beauty of this system is that you create content once, and it flows to clients via whatever channel they’re using at the time. No more wondering if they saw your email or logged into the portal. You’re meeting them wherever they are.

Beyond Basic Portals: What Sets Blueleaf Engage Apart

In addition to the proactive, multi-channel delivery model, here’s what truly sets Blueleaf Engage apart from traditional client portals and point solutions:

Complete Unified Platform: This might be the biggest game-changer. Most firms are cobbling together multiple systems: one for portfolio reporting, another for content distribution, a third for document sharing, and maybe a separate messaging tool. Your clients end up with multiple logins, and you’re managing multiple vendor relationships.

Blueleaf Engage unifies all of these: updated financial data, advisor-created content, document sharing, and secure two-way communication in a single, branded client experience. Your clients have one place to go for everything. One login. One consistent experience with your brand front and center.

Platform Independence: Here’s what makes this practical: Blueleaf Engage works alongside your existing wealth management platform, whether that’s Orion, BlackDiamond, Addepar, or any other system. You don’t have to rip out your operational infrastructure to deliver a revolutionary client experience. You can start engaging clients tomorrow, regardless of your current tech stack.

Social Interaction Model: This isn’t just content broadcasting. Clients can like and comment on your posts, creating a natural two-way dialogue within a compliant framework. It’s the engagement pattern they’re already comfortable with from LinkedIn and other platforms, applied to their financial life.

Enterprise-Grade Compliance: We’ve built AI-powered content screening directly into the platform. Content gets automatically reviewed, flagged if necessary, and routed through your approval workflows. Complete audit trails. Multi-tier approvals. This is the only social-style engagement solution designed for enterprise RIAs and broker-dealers from the ground up. You get a consumer-grade user experience with enterprise oversight.

Direct Data Access: Portfolio information flows directly without third-party integration dependencies. This means faster implementation, lower costs, complete data control, and most importantly, reliability. You’re not dependent on someone else’s integration breaking.

Why Now?

Three major forces are converging to make client engagement critical right now:

Generational Wealth Transfer: As wealth moves to younger, digitally-native generations, they expect modern digital experiences. If your client portal looks like it was built in 2010, you’re not going to retain the next generation of clients.

Competitive Pressure: Most of the major digital services your clients use set a high bar for user experience. Your human expertise is your advantage, but only if you combine it with a client experience that meets modern expectations.

Media Saturation: The volume of financial noise your clients encounter has exploded. Social media, 24/7 financial news, Reddit, TikTok: there’s never been more bad advice competing for your clients’ attention. You need a way to counteract that.

Who Blueleaf Engage Is Built For

We’ve designed Blueleaf Engage for forward-thinking, growth-focused wealth management firms who understand that client experience is a competitive differentiator:

- Enterprise Wealth Managers who need a custom-branded experience with compliance oversight and comprehensive analytics

- Growth-Focused RIAs who want to scale without sacrificing the personal touch

- Regional Broker-Dealers looking to provide modern tools to their advisors

If you’re an advisor who’s struggled with client portal adoption, or a firm leader who knows your current client experience isn’t where it needs to be, Blueleaf Engage is built for you.

Real Results From Early Adopters

The proof is in the numbers. Our customers report:

- 60-90% monthly client engagement compared to the industry standard of 10%

- Reduced panicked calls during market volatility because clients are already informed

- Higher client satisfaction scores driven by feeling more connected to their advisor

- More referrals because engaged clients naturally talk about their positive experiences

- Increased share of wallet as clients consolidate more assets with advisors they’re actively engaged with

One of our long-time customers told me, “I used to measure success by whether clients seemed happy at their annual review. Now I measure it by whether they’re engaging with the content I send them every week. And they are. It’s completely changed how I think about the value I deliver.”

Getting Started Is Simple

We’ve learned that the biggest barrier to adopting new technology isn’t the technology itself: it’s the fear of disruption and complexity.

That’s why we’ve made implementation straightforward:

Week 1-2: Platform setup, brand customization, and data integration

Week 3-4: Team training and client rollout

Most firms are fully operational and seeing results within 30 days. And because Blueleaf Engage works alongside your existing systems, you’re not ripping out infrastructure.

Our team provides hands-on support throughout the process, including best practices from hundreds of successful implementations.

The Bottom Line

For too long, the wealth management industry has accepted low portal engagement as normal. We’ve told ourselves that clients just aren’t interested in digital tools, or that the personal relationship is all that matters.

But the truth is simpler: we’ve been building the wrong tools.

Clients want to engage with their advisors. They want to understand what’s happening with their money. They want to feel connected to the people managing their financial lives.

They just don’t want to have to do all the work to make that happen.

Blueleaf Engage solves this problem by bringing proactive, multi-channel, social media-style engagement to wealth management. It’s the client experience platform we’ve been building toward for over a decade, informed by thousands of advisors and millions of client interactions.

If you’re ready to transform client engagement from something that happens 10% of the time to something that happens 60-90% of the time, we’d love to show you how Blueleaf Engage can work for your practice.

Schedule a demo today and see firsthand how the most successful advisors are keeping clients engaged, informed, and loyal in the digital age.

Explore our site or reach out to our team directly. Let’s build the client experience your clients deserve, and your practice will thrive.

Welcome to the engagement economy. We’re glad you’re here.